Category: Patient Lifts

Posted by 2025-12-06 09:12

power lift chairs covered by insurance

Are Power Lift Chairs Covered by Insurance? Understanding Policies, Realities, and Viable Alternatives

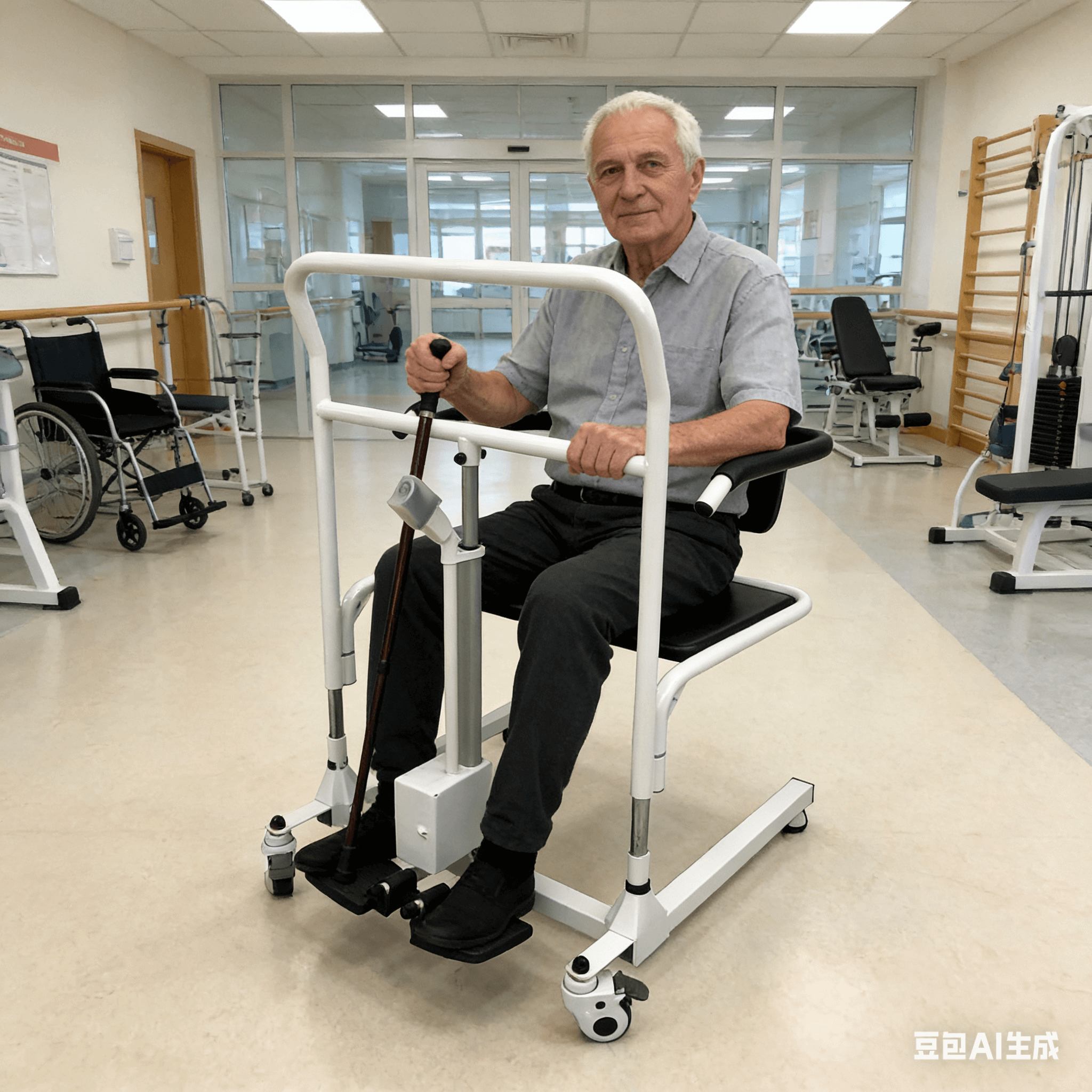

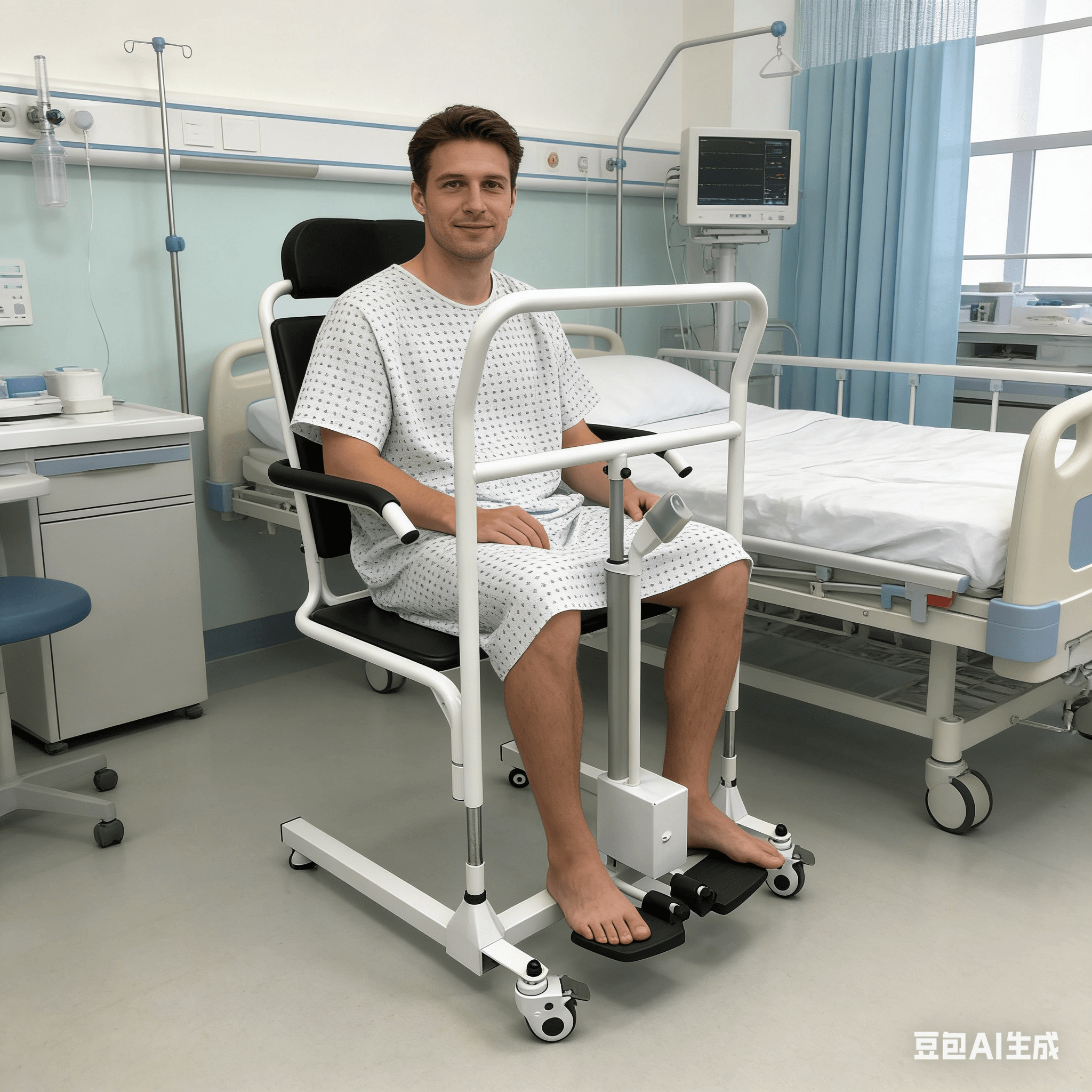

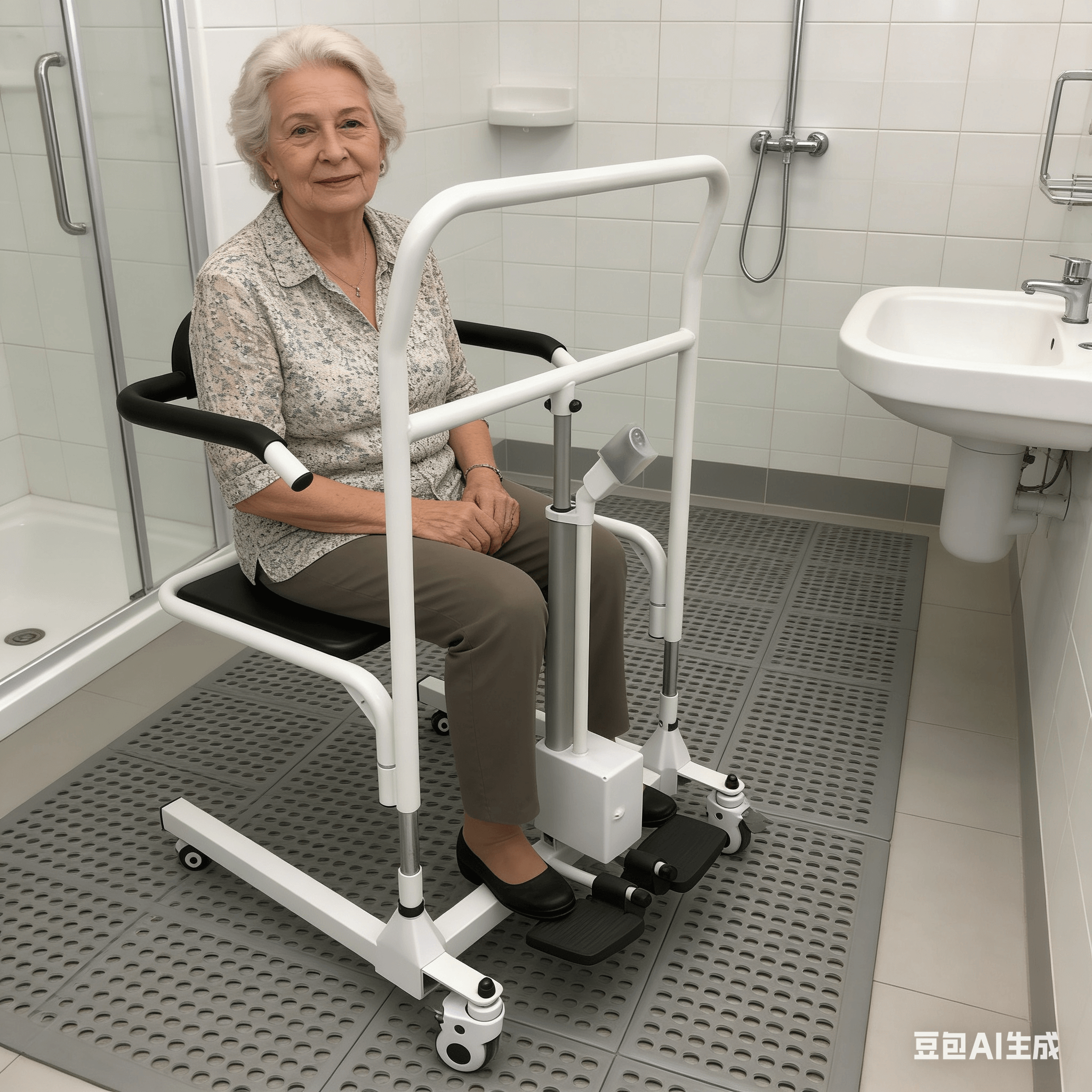

When elderly family members struggle to stand up safely from a regular sofa due to arthritis, post-surgery recovery, stroke, or other chronic illnesses, many families consider purchasing a Power Lift Chair for support. However, faced with prices that often range from hundreds to thousands of dollars, many people hopefully ask the question: “Are power lift chairs covered by insurance?”

The answer is not straightforward—it depends on the type of insurance you hold, the country or region you live in, proof of medical necessity, and the classification of the device itself. In most cases, commercial health insurance and government-sponsored health insurance (such as Medicare in the U.S. and provincial health insurance in Canada) do not cover standard power lift chairs, but certain specific plans or supplementary insurance may provide partial support.

Why Do Most Insurance Plans Not Cover Power Lift Chairs?

Insurance companies typically classify power lift chairs as “home comfort items” rather than “medically necessary equipment.” Although these chairs do assist with standing up and reduce the risk of falls, their appearance and structure are highly similar to traditional sofas, and they lack clear medical treatment functions.

For a device to be covered by insurance, it usually needs to meet the following criteria:

Explicitly identified as “medically necessary” by a doctor;

Used to treat or manage a specifically diagnosed condition;

Classified as an approved “Durable Medical Equipment (DME)” by the insurance company;

Purchased through an authorized DME supplier with a detailed prescription.

Unfortunately, the vast majority of power lift chairs on the market do not meet these standards and are therefore excluded from regular reimbursement.

Insurance Coverage by Plan Type

1. U.S. Medicare (Original Plan)

Medicare Part B almost never covers standard power lift chairs. It only reimburses for medically defined recliners that meet strict criteria (such as fully electric hospital-style chairs with HCPCS code E0635), and coverage is usually limited to rental rather than purchase. Even then, approved cases are extremely rare.

2. Medicare Advantage (Part C)

Medicare Advantage plans, offered by private companies, have greater flexibility in coverage. Some plans may include power lift chairs as a “supplemental benefit” under categories like “home safety” or “chronic disease management,” especially those that emphasize fall prevention. However, you must:

Review your annual Summary of Benefits;

Obtain a joint assessment from a doctor and an occupational therapist;

Purchase the chair through a designated supplier.

Even if coverage is available, there may be limits (e.g., a $300–$500 annual subsidy).

3. U.S. Medicaid

If you qualify for both Medicare and Medicaid (“dual eligible”), Medicaid in some states may cover power lift chairs, provided that:

A doctor provides proof of “medical necessity”;

The device is obtained through a state-certified DME supplier;

The chair meets the specific coding and approval requirements of that state’s Medicaid program.

Policies vary significantly by state—contact your local Medicaid office for confirmation.

4. Canadian Provincial Health Plans

Canada does not have a unified national policy, but some provinces offer funding through assistive device programs:

Alberta Aids to Daily Living (AADL) Program: Eligible individuals can receive subsidies of up to 75% (with an annual out-of-pocket maximum of $210);

Provinces like British Columbia and Ontario: If an occupational therapist assesses the chair as “necessary,” partial funding may be available through home care programs;

Veterans Affairs Canada (VAC): Eligible veterans may receive full or partial reimbursement.

The key requirement is that the application must be submitted through a designated supplier, accompanied by a professional assessment report.

5. Private Commercial Health Insurance

Most employer-sponsored commercial insurance plans do not cover power lift chairs, as they are not considered core medical benefits. A small number of high-end plans may include a category for “assistive living equipment,” but approval is case-by-case and success rates are low.

6. Workers’ Compensation or Auto Insurance (If Applicable)

If mobility impairment results from a work-related injury or car accident, relevant compensation insurance (such as Workers’ Compensation or ICBC in Canada) may cover power lift chairs as part of rehabilitation or home modifications. Medical documentation must be submitted and reviewed by a claims adjuster.

How to Increase the Likelihood of Insurance or Funding Approval?

Obtain a Professional Medical Assessment

Ask your family doctor for a referral to an Occupational Therapist. They can conduct a home safety assessment and issue a formal report explaining why a power lift chair is “medically necessary” to prevent falls and support independent living.

Use Correct Device Descriptions and Coding

Avoid using home-related terms like “lift chair” or “recliner.” Instead, use terminology such as “motorized assistive seating device for mobility impairment” in applications, and reference HCPCS codes or provincial equipment codes (if applicable).

Purchase Through a Certified DME Supplier

Even if insurance ultimately does not provide reimbursement, buying through a formal medical equipment supplier ensures device quality and preserves eligibility for future applications for community assistance.

Explore Non-Insurance Funding Channels

Nonprofit Organizations: Such as the Canadian Red Cross, Salvation Army, and local Lions Clubs;

Community Senior Service Centers: Offer assistive device lending libraries or small grants;

Refurbished Models or Rental: Significantly reduce costs, suitable for short-term needs or families on a budget.

Practical Tips for Family Caregivers

Do not assume insurance will cover the cost—plan for out-of-pocket expenses to avoid financial surprises;

Prioritize suitability over price—a poorly chosen chair may cause discomfort or even injury;

Keep all medical records and communication documents—even if no reimbursement is available now, they may be useful for future applications for other assistance;

Consult social workers or case managers—if you already use home care services, they are usually familiar with local funding resources.

Conclusion

While most insurance plans do not cover power lift chairs, this does not mean you have to bear the entire cost alone. By understanding policy boundaries, obtaining professional assessments, and using cost-effective purchasing strategies (such as certified refurbished models, provincial subsidies, or community assistance), you can still find a safe, comfortable, and affordable power lift chair for your loved one.

True care is not about how expensive a device is, but whether it can steadily support a safe stand every morning, afternoon, and evening. This sense of security is worth taking the time to pursue—even if insurance does not cover the cost, love can still make it happen.